Oroco Resource Corp. is a Canadian junior exploration company with an exciting copper project in Mexico. The Santo Tomás project currently has an historic resource of 2.65Mt of contained copper which is open in all directions.

The use of modern exploration techniques may validate historical projections of 7.0Mt copper. Indications of this potential are already clear in the recently completed 3D IP survey.

A Significant Copper Asset: Oroco currently holds a 73.2% interest in the Santo Tomás copper project in Mexico, which can be increased to 85.5% with

additional project investment. Extensive historical work has defined a very large outcropping porphyry copper deposit and demonstrated the project’s

viability through completion of an historical PFS.

Good Infrastructure and Location: The project is located in Mexico, a top tier mining jurisdiction with outstanding local infrastructure available to

support large-scale mining activities, strong local mining culture and highly supportive community. The project benefits from significant potential capex and operating cost advantages due to its favourable location.

Large Copper Resource: A total Measured and Indicated historical resource of 822Mt grading 0.322% copper was outlined, containing 2.65Mt (5.84bn

pounds) of copper, within which exists a higher-grade core of 333Mt grading 0.437% copper. By-product gold, silver and molybdenum are also present but were not historically assayed for and are as yet unquantified.

A Focus on Expanding the Resource: Oroco has a highly experienced board and management team which has been assembled to direct the project’s

exploration and development. Management’s strategy and focus is on the confirmation and expansion of the historical resource and ultimately an exit

through divestment of the project.

Extensive Exploration Upside: The aim of the current exploration campaign is to verify and build upon the historical work. Significant resource upside is anticipated through the use of modern exploration techniques and already this potential has been indicated from the successful results of a 3D IP survey just released.

A major drill program is now being planned for later this year. M&A Potential Supports a Strong Valuation: We have tried to consider what Oroco could be priced at in an M&A situation as we believe it has an asset that may be attractive to a top tier copper producer. Based on previous work, we have applied a takeover value US$193/t resource for a feasibility stage project on a resource of at least 3-4x the historical resource calculation.

This gives a takeover target share price for Oroco of C$8.66-11.55/share.

Assuming share price represents a takeover price including a 30% premium, we place an 18 to 24-month trading price range of C$6.66-8.88/share on

Oroco, a significant premium to the current share price.

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

Mar-21 Apr-21 May-21 Jun-21

Volume (million)

Price (C$) – LHS

Overview of Oroco Resource Corp. Oroco Resource Corp. is a Canadian-listed mining company that was established in 2006 to develop resource opportunities in Mexico. The main focus is currently on the Santo Tomás project in northwest Mexico.

The company is listed on the TSX Venture Exchange under the symbol OCO, and it also trades on the Frankfurt Stock Exchange Open Market under the trading symbol OR6 and the US OTC exchange under the trading symbol ORRCF.PK.

In March 2020, pursuant to an option agreement, Oroco acquired 100% ownership of Altamura Copper Corp. Altamura currently holds a 73.2% interest in Xochipala Gold, which holds the registered title to the seven mineral concessions which cover the known core of the Santo Tomás project. A highly experienced board and management team has been assembled to direct the development of the project.

During 2020, Oroco raised some C$25.1m in four private placements, essentially to finance further exploration of the Santo Tomás project. This included C$0.75m in March 2020, C$1.7m in June 2020, a further C$7.3m in September 2020, and then C$15.5m in December (see Recent Financings, page 21). As at the end of February 2021, the company had net cash and marketable securities of C$22.0m.

Santo Tomás Exploration Project

The company holds a net 73.2% interest in the core concessions of the Santo Tomás project in Mexico and may increase that majority interest to an 85.5% interest with a project investment of up to C$30m. It also holds a 77.5% interest in significant mineral concessions surrounding and adjacent to the core concessions. The project is located within 160km of the Pacific deep-water port at Topolobampo and serviced via a highway and proximal rail which has parallel corridors of trunk grid power lines and natural gas.

The concession area hosts a significant copper porphyry deposit defined by prior exploration spanning the period from 1968 to 1994. During that time, the property was tested by over 100 diamond drill and reverse circulation drill holes, totalling approximately 30,000m. Three zones of copper mineralisation were identified called the North Zone, the South Zone and Brasiles Zone.

Based on data generated by these drill programmes, a resource estimate for the project was calculated and metallurgical test work was conducted, which resulted in the completion of Prefeasibility Study in 1994.

A total Measured and Indicated historical resource of 822Mt grading 0.322% copper was outlined, containing 2.65Mt (5.84bn pounds) of copper. By-product gold, silver and molybdenum are also present but were not historically assayed for and are as yet unquantified. Within this sizeable historical mineral resource, there exists a higher‐grade core comprising 333Mt at an average grade of 0.437% copper.

Studies have shown potential for a project-wide endowment of greater than 7Mt of contained copper. Oroco published a Revised Technical Report on Santo Tomás and the historical resource in April 2020.

New Exploration

The main exploration work by Oroco commenced in September 2020 with the preparation for an exploration drill programme, acquisition of surface rights and permits, and a 3D IP geophysical survey. This is the first modern ground geophysical survey conducted at Santo Tomás. The aim of the current exploration campaign is to verify and build upon an updated geological model and a substantial body of historical drilling, mineral resource estimates, and the Prefeasibility studies.

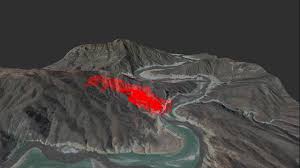

Results of the 3D IP survey were released in June 2021 and initial interpretation by geophysical contractors and Oroco management point to very significant implications for future exploration success at the project.

It indicates a substantial continuation of Santo Tomás chargeability along strike and to depth, inferring that the mineralised system is much more extensive than was defined historically. In addition to the strike continuity, chargeability features at South Zone and Brasiles protrude east of their anticipated distribution, and a distinct feature of intermediate chargeability is developed westward below a mapped limestone bluff at Brasiles.

The 3D IP results will be used to guide the targeting of future drilling at the Santo Tomás South, North and Brasiles Zones. A 70,000m drilling campaign is planned for later this year.

Mine Development and M&A Potential

Oroco is now developing a very promising copper deposit that with further successful exploration and permitting has the potential to be progressed through to an operating copper mine. In the meantime, we believe that there are only eight copper projects globally, not already owned by the major mining companies or top tier copper producers, that could be considered as potential takeover candidates under our criteria, and the Santo Tomás project is one of them. This clearly places Oroco as a potential M&A candidate as the project develops.

2.0 The Santo Tomás Project

The focus of Oroco Resource Corp. is the Santo Tomás project which hosts a significant copper porphyry deposit defined by prior exploration. It is currently one of the largest undeveloped copper projects, not owned by a major mining company but with a high probability of development1

. It currently contains an historical resource of about 2.7Mt contained copper.

Oroco holds a net 73.2% interest in the collective 1,173 ha core concessions of the project and may increase that majority interest up to an 85.5% interest with a project investment of up to C$30m. Oroco also holds a 77.5% interest in 7,808 ha of mineral concessions surrounding and adjacent to the core concessions (for a total project area of 22,192 acres).

The project has good infrastructure, a potentially low strip ratio, and appears to have no environmental issues. Furthermore, it is fully statutorily compliant, with existing mining concessions. In Mexico, the term “concession” refers to mining lots, that are valid for fifty years and renewable for one additional 50‐year period.

Location The Santo Tomás project is located in the municipality of Choix, in northern Sinaloa State, México, some 160km from the Pacific deep-water port of Topolobampo. The project is serviced via highway and proximal rail through the city of Los Mochis to the northern city of Choix. The property is reached by a 32 km access road originally built to service Goldcorp’s El Sauzal mine in Chihuahua State.

The project has good infrastructure with parallel corridors of trunk grid power lines linked to the hydropower at the nearby Huites Dam and a new natural gas pipeline lies within 20 km of Santo Tomás. There is also an international airport at Los Mochis some 160km to the southwest.

The Property area is mountainous and is part of the southwestern Sierra Madre Occidental mountain range. The topography of the area is deeply incised with steep‐ walled valleys. There are a number of regional population and commercial centres and the area is reported to have a strong local mining culture and highly supportive community.

Geology

The Santo Tomás properties lie within the Laramide porphyry copper province of southwestern US and northern Mexico, which is one of the world’s great concentrations of porphyry deposits, rivalling the Tertiary age deposits in the southern Andes or the Philippine Islands.

Most of the known porphyry copper deposits in Mexico lie along a 1,500 km‐long, NW trending belt subparallel to the western coast of Mexico. This belt extends from the U.S. border through the states of Sonora (the Cananea and La Caridad deposits), western Chihuahua, Sinaloa, Michoacán (the Inguarán deposit), and Guerrero. The deposit at Cananea (>20 Mt contained copper) in Sonora is among the 15 largest

porphyry copper deposits in the world.

The Santo Tomás deposit lies within the Sierra Madre Occidental belt of Mexico. This region is underlain by the Guerrero terrane characterised by volcanic and volcaniclastic sequences associated with island arcs of Middle Jurassic and Early Cretaceous age. The bedrock in the Santo Tomás region is predominantly comprised of older, Mesozoic‐aged, bedded, carbonate‐rich sediments including limestone, marble bodies, sandstones, and large volumes of andesitic volcanic rocks.

The Santo Tomás mineral camp is characterised by copper porphyry and skarn replacement style mineralisation. The main portion of the deposit consists of a zone of disseminated copper along the axis of multiple quartz monzonite porphyry dykes.

Mineralisation at Santo Tomás is mostly comprised of chalcopyrite, pyrite, and molybdenite sulphides with minor bornite, covellite, and chalcocite, which occur as fracture fillings, veinlets, and fine disseminations together with potassium feldspar, quartz, calcite, chlorite, and locally, tourmaline. Minor copper oxides occur near the surface but are not significant.

The porphyry copper mineralisation is sulphide‐ dominant with chalcopyrite being the main copper‐bearing sulphide mineral.

Historical Exploration

The Santo Tomás deposit is exposed in outcrop pattern along a 5 km strike length.

South of Rio Fuerte, mineralisation on the eastern and western flanks of the N-S Santo Tomás ridge are called the North Zone and South Zones, respectively. A mineralised zone lying north of the Rio Fuerte river is termed the Brasiles Zone.

The South Zone is the mineralised zone that previously was studied by Bateman (1994) and was the subject of a pit design. It lies on the crest and

west slope of the Santo Tomás Ridge. On the South Zone, extensions onto the Peripheral Concessions are evidenced by historical drilling data.

The North Zone is the main mineralised zone on the property that previously was studied by Bateman (1994) and the subject of a pit design. The zone lies on the eastern flank of the Santo Tomás Ridge, south of the Rio Fuerte river.

Brasiles Zone is the NNE strike projection of the North Zone across the Rio Fuerte river and lies on the north bank of Rio Fuerte. Historical information and recent geological mapping demonstrated that the Brasiles Zone extends from the Core Concessions to the northeast onto the Peripheral Concessions.

Before formal exploration of the Santo Tomás deposit, informal miners had been working the site sporadically since the early 1900s. The development consists of several small excavations and two small adits in the North and South Zones.

The Santo Tomás copper porphyry deposit has been defined by prior exploration spanning the period from 1968 to 1994. During that time, the property was tested by over 100 diamond and reverse circulation drill holes, totalling approximately

30,000m.

The main mineralised zone varies between approximately 100 to 600m in true thickness and dips moderately to the WNW at 50° in the North Zone. Similar moderate angle dips are apparent in the South Zone and Brasiles. Based on data generated by these drill programmes, an historical Prefeasibility Study (PFS) was completed by Bateman Engineering in 1994. Updates of the study were made in 2003 and 2011. A technical report was published in August 2019.

A total Measured and Indicated historical resource of 821.7Mt grading 0.322% copper was outlined, containing 2.65Mt (5.84bn pounds) of copper. By-product gold, silver and molybdenum are also present at low levels, but previous work has not included these metals as the historical sampling is not as complete as it is for copper.

Within this sizeable historical mineral resource, there exists a higher‐grade central area in the North Pit area, that outcrops at the surface and dips to the west, within a broad structural/intrusive zone. At a 0.35% copper cut-off grade, the results show a higher‐grade component of mineralisation in the historical Measured and Indicated mineral resource estimate that consists of 333Mt at an average grade of 0.437% copper, for a total of 3.20bn pounds of copper.

care of the redaction